Ansarada wrapped 2025: Your year in deals, infrastructure and industry-defining insights

2025 was a year of bold predictions, powerful stories, and insights that shaped both the dealmaking and infrastructure procurement markets.

2025 was a year of bold predictions, powerful stories, and insights that shaped both the dealmaking and infrastructure procurement markets.

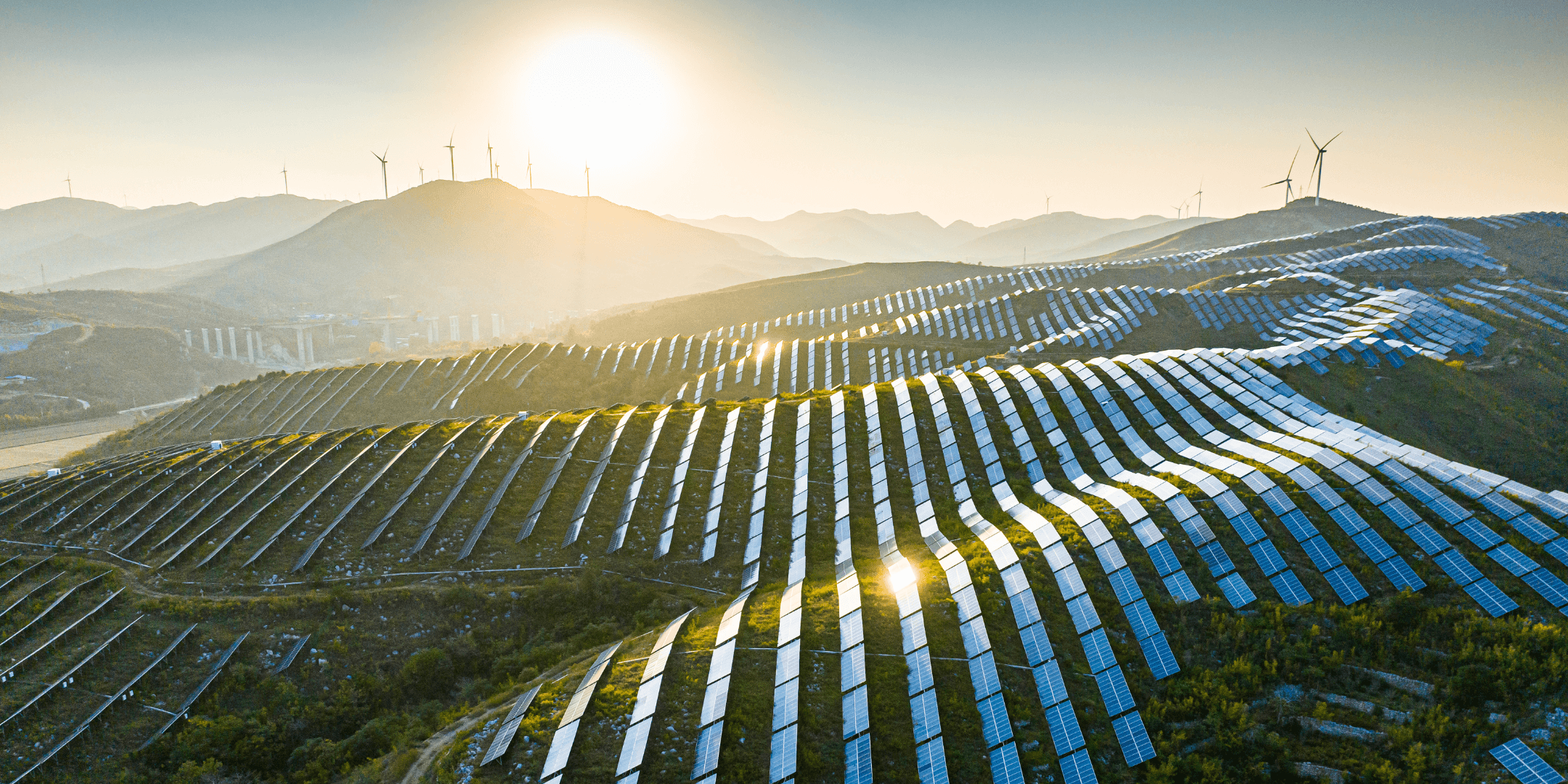

Australia’s ongoing construction and infrastructure boom has seen overseas investors home in on suppliers of essential building products.

After a flat few years, better times are expected for the Kiwi transaction market in 2026.

Despite the uncertain interest rate outlook, property investors are bullish about this stalwart asset class.

With a flat banking transaction market, Australian and New Zealand investors are hopeful of better times ahead in 2026.

AI and hot demand for data centres means the outlook for tech M&A is rosy.

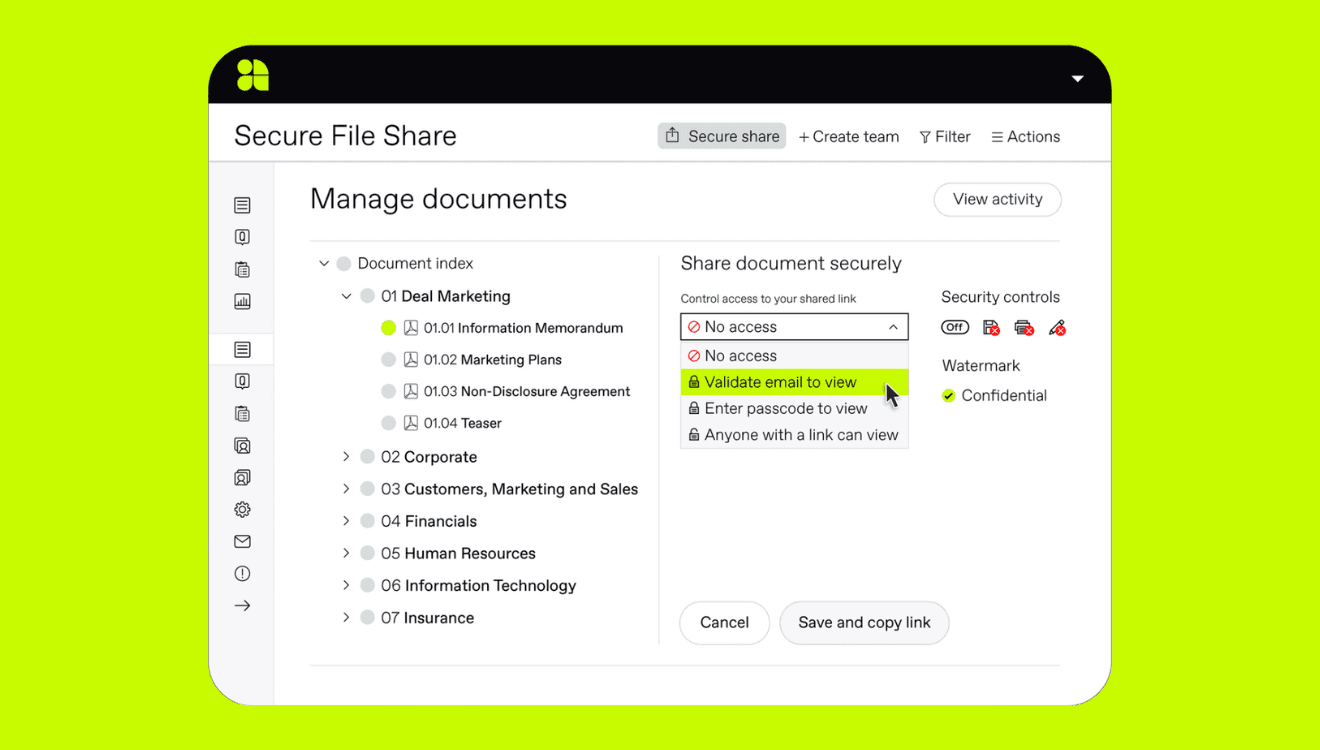

As an Analyst or Associate who’s juggling multiple deals, working long hours and buried in spreadsheets, choosing the right Virtual Data Room (VDR) isn’t a nice-to-have; it’s essential.

From 1 January 2026, Australian dealmakers face mandatory merger notification – meaning even straightforward acquisitions must clear ACCC approval within 30 days, with complex deals facing up to 90 days of rigorous review. Early preparation and strategic timing have never been more critical.

Expect a growing range of opportunities to hit the bourse as Middle Eastern economies diversify.

With abundant natural resources, New Zealand as a market is known for its energy transactions and energy plays have dominated deal flow throughout 2025, with eight major rumoured or announced deals totalling $1.0 billion, according to Mergermarket’s data.

Australia’s ongoing construction and infrastructure boom has seen overseas investor interest in essential building product suppliers.

Investors continue to home in on innovation and consolidation opportunities.

Combined new entity a new force in the nation’s telecommunications market.

While it remains an emerging market, Africa’s up-and-coming generations will help support economic growth across the continent, according to Stokoe.

Off the back of a sluggish 2024, the Lion City has experienced a wave of mergers and acquisitions through 2025, with tech deals dominating deal flow.